TRACS Shipping Activity Overview

Below we show some of the seaborne trade and shipping demand data extracted from TRACS – Oceanic’s proprietary vessel tracking system.

Some of the interesting points to note for 2025 are:

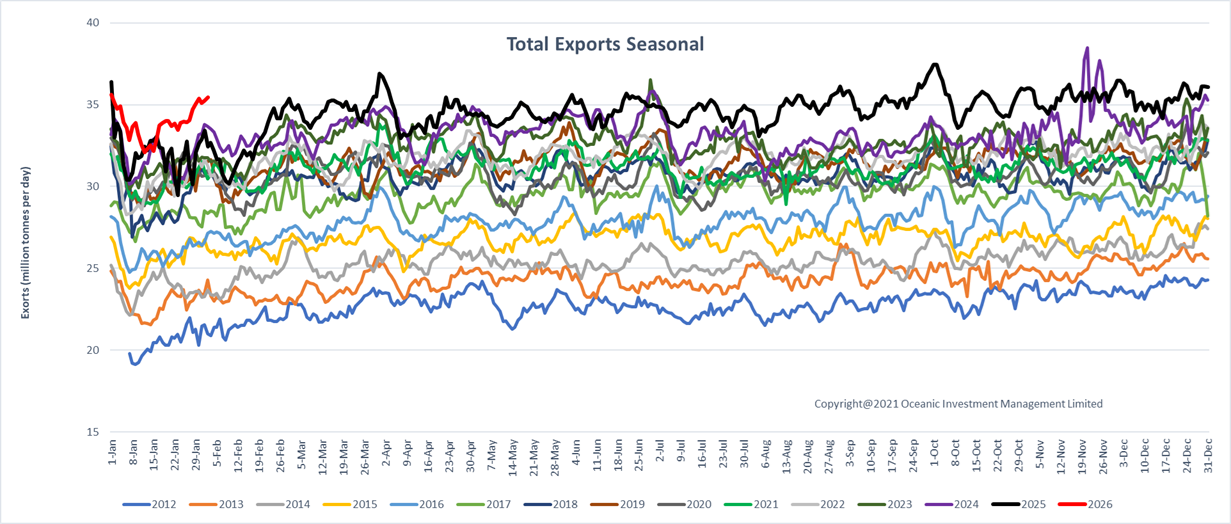

Shipping demand in terms of the tonnage exported is only marginally above the pre-Covid-19 levels - (Chart 1 below).

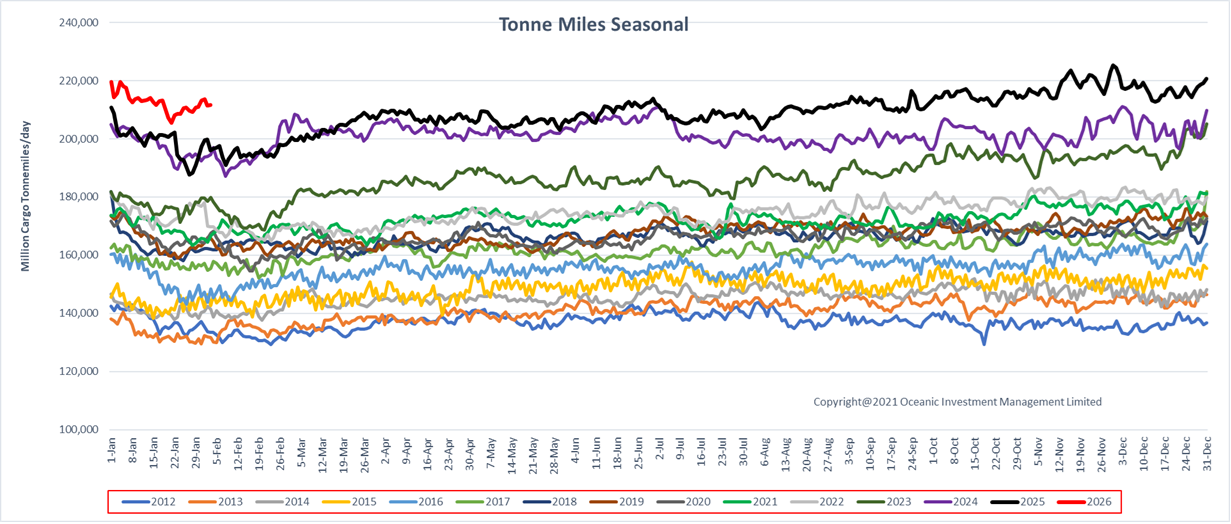

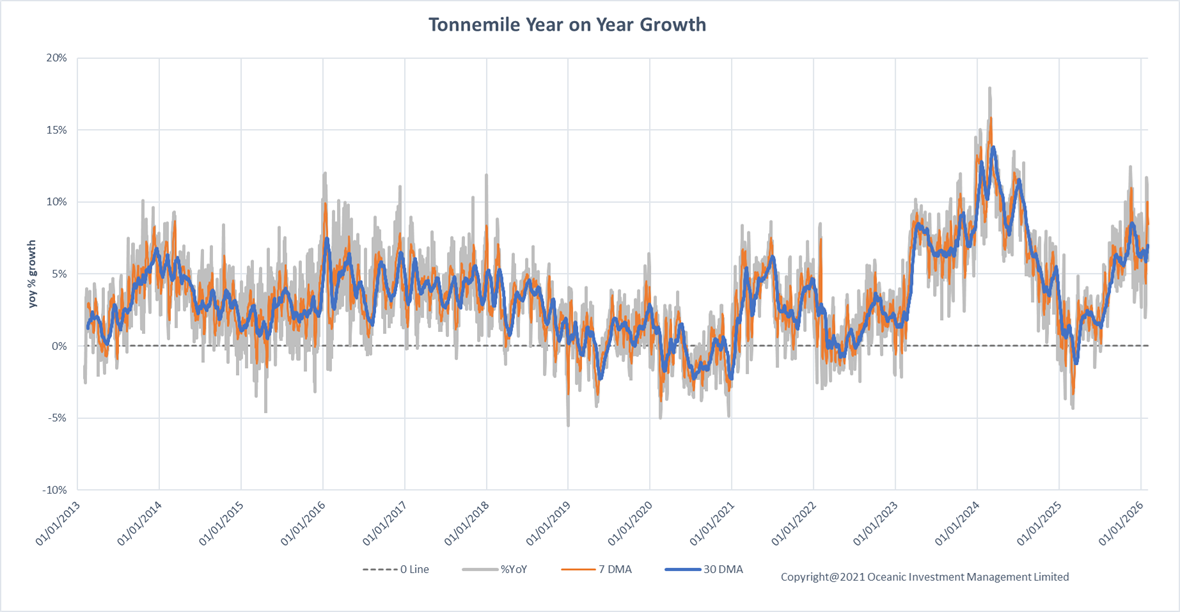

Shipping demand in tonne-mile terms is normalising after 2 very strong years when disruptions to seaborne trade - together with strong demand for Atlantic basin commodities from Asia and Chinese manufactured goods from Europe and America led to a lengthening of trade routes - (charts 2, 3).

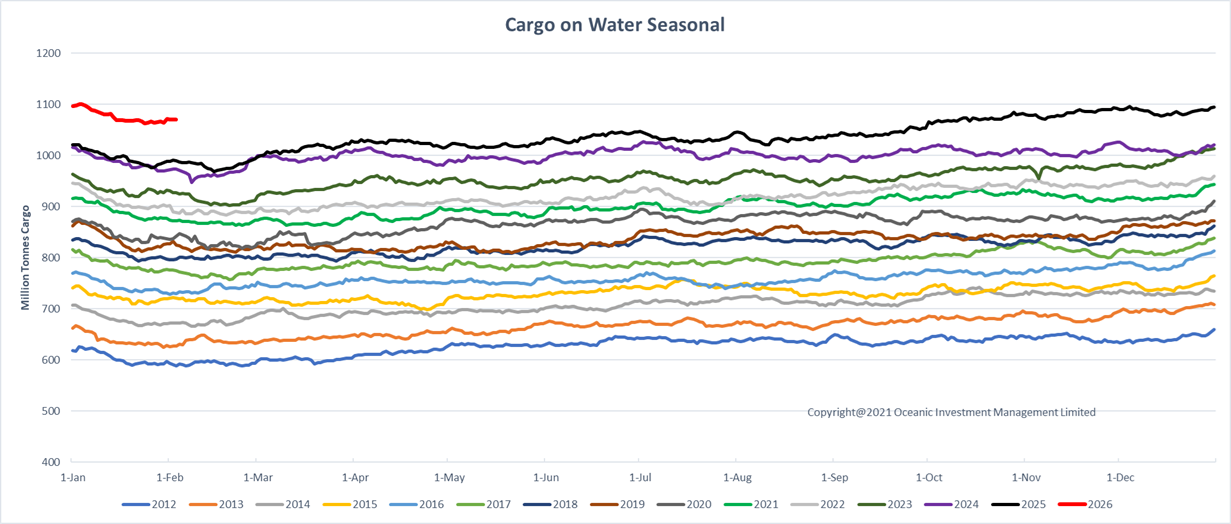

Cargo in transit is also normalising after the strong growth in 2023 and 2024 - (Chart 4).

The fleet is continuing to slow down to reduce fuel consumption and emissions and meet increasingly stringent environmental criteria - (Chart 5).

The port congestion experienced in the aftermath of Covid-19 has normalised and improved the fleet efficiency - (Chart 6).

After suffering drought conditions in 2023, the weather in Panama has normalised, improving throughput through the Panama Canal which had been curtailed during 2023 and 2024 – forcing ships to sail round Cape Horn or Cape of Good Hope - (Chart 7).

The traffic passing through the Suez Canal is continuing to drop - forcing more traffic to go round the Cape of Good Hope - (Chart 8).

Chart 1

This shows the total tonnage of cargo exported and imported which is a measure of demand for cargo to be shipped.

Chart 2

Tonne Miles is the total tonnage of cargo being carried multiplied by the distance the vessels travel daily. This is a measure of the “true “demand for shipping services incorporating the amount of cargo along with the distance the cargo is carried.

Chart 3

This chart shows the tonne mile data as a % growth year on year, a methodology that removes the majority of the seasonality from the data.

Chart 4

This chart shows the total daily amount of all cargo types loaded aboard the global fleet at any moment in time. Cargo includes crude oil and products, dry bulk, containers, LNG, LPG, vehicles and chemicals. This metric of shipping demand incorporates delays due to port congestion and slow steaming of the fleet as well as floating storage.

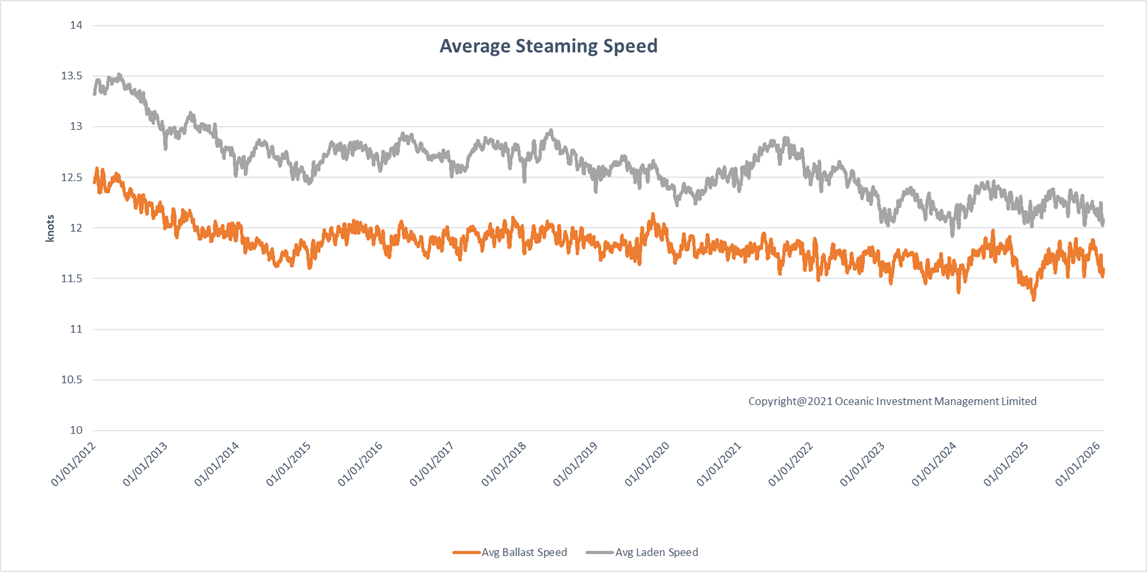

Chart 5

The average speed of the fleet is another metric we follow; this chart shows average speed of world's seagoing fleet measured in knots. The speed is in structural decline reflecting both a rising cost of fuel and the tightening emissions regulations forcing the fleet to slow down to reduce emissions. In the short term however, when utilisation tightens and rates improve then vessels will speed up to take advantage of the higher earnings potential, so optimum speed is a dynamic factor.

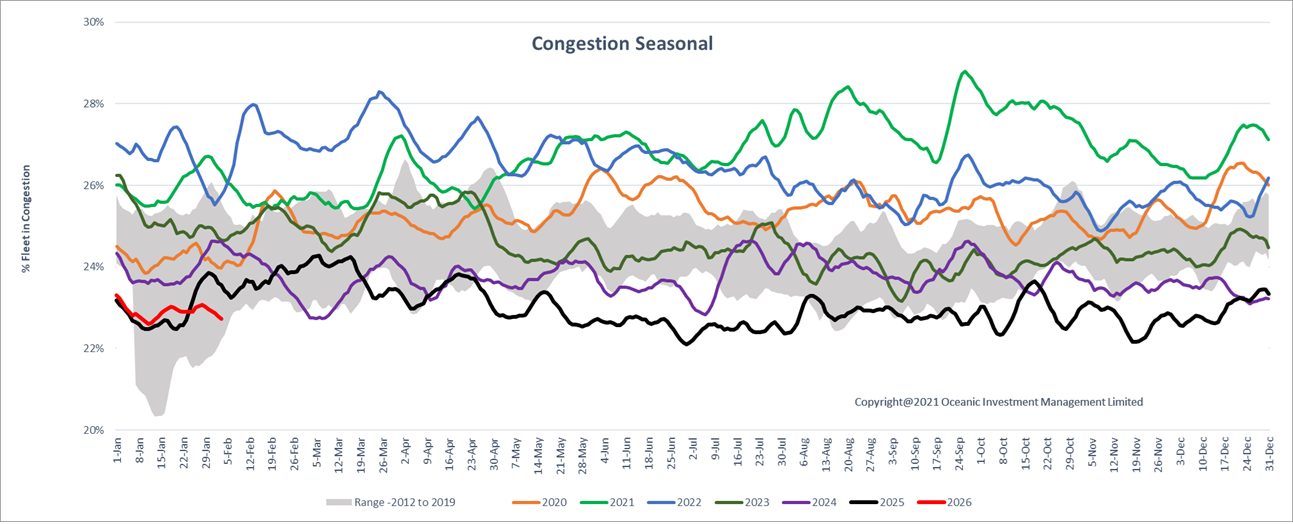

Chart 6

Congestion has been an important factor over the last few years as Covid prevented the normal operation of ships and ports during 2020 – 2021. Since 2022 congestion has unwound - making the fleet more efficient and able to absorb the additional demand experienced in 2023 and 2024.

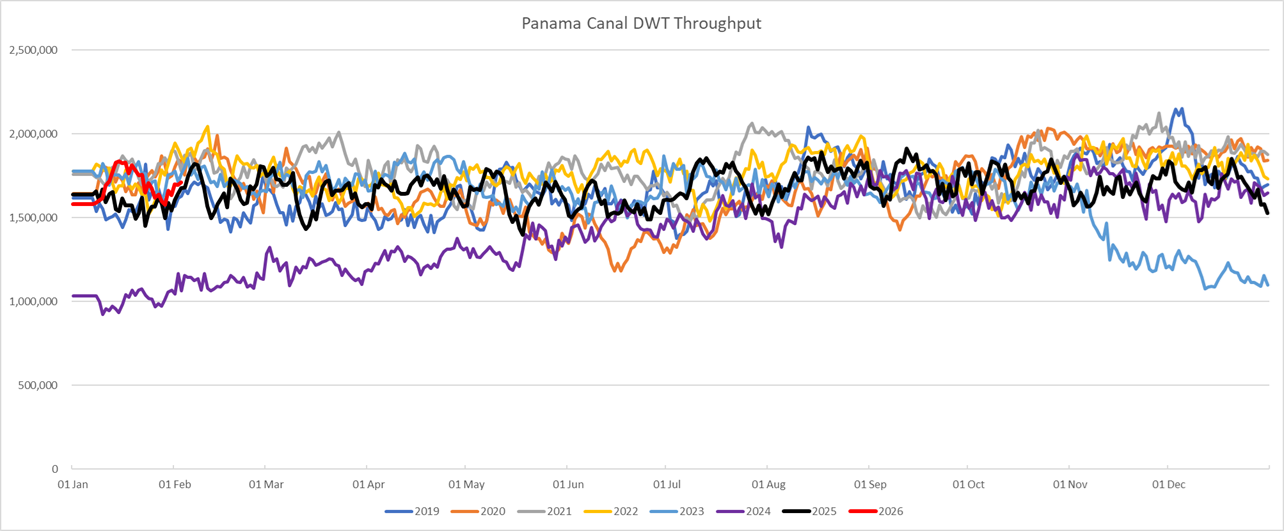

Chart 7

The Panama Canal suffered drought conditions in 2023 and early 2024.

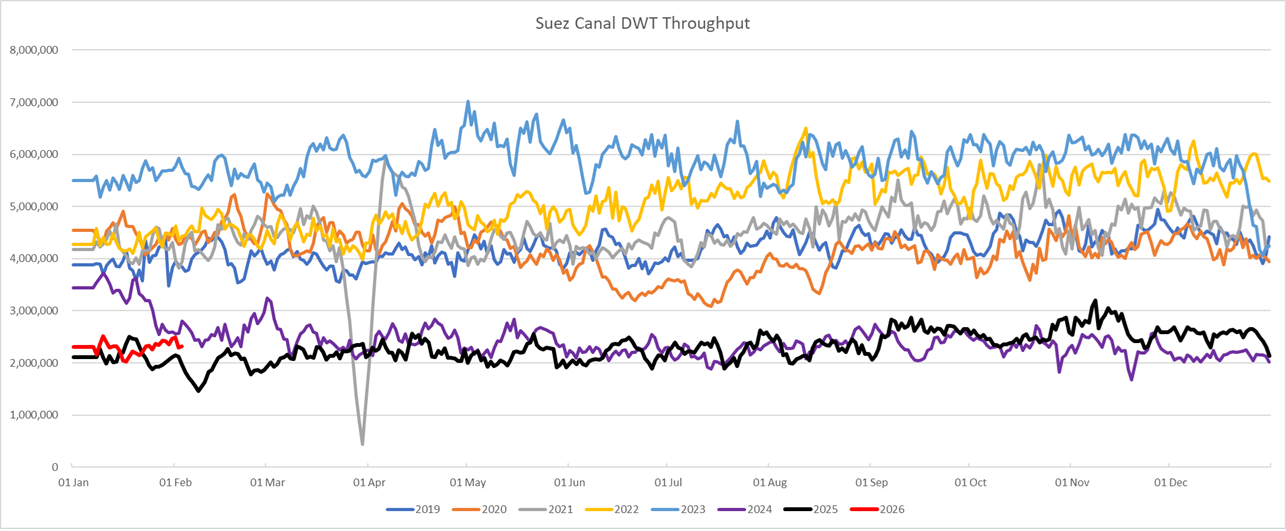

Chart 8

The Houthi attacks on shipping have forced much of the Suez Canal traffic to go round the Cape of Good Hope since the end of 2023.